How IRA Tax Credits Drive Home Improvements and Energy Independence

In today's ever-changing housing market, homeowners are keenly aware of the benefits of home remodeling and improvements. Recent insights highlight how the Inflation Reduction Act (IRA) tax credits not only foster significant advancements in energy production but also invigorate the construction and manufacturing sectors across the nation—undeniably impacting both red and blue states.

Bridging Political Divides with Energy Innovations

While some critics view the IRA with skepticism regarding its effects on inflation, a closer examination reveals concrete advantages. These tax credits are essentially catalysts attracting investments that lead to job creation in sectors vital for energy independence. For homeowners, this translates into rising options for home improvement services including kitchen remodeling and bathroom renovations.

Meeting Future Energy Demands with Smart Practices

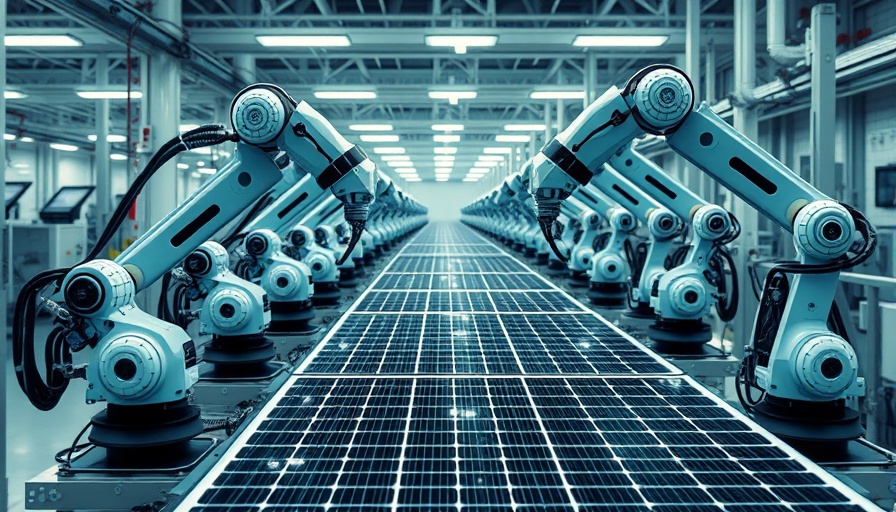

The U.S. energy generation systems are straining under rapidly increasing demands, driven further by urbanization and electric vehicle use. The expansion of renewable energy through tax credits not only promotes cleaner power but enables contractors across the nation to leverage these innovations in home designs and renovations. As more households look for eco-friendly renovations, accessing contractors near me well-versed in sustainable practices becomes crucial.

Future Predictions: Embracing Energy Efficiency

As the national electrical grid faces obsolescence, investments spurred by the IRA tax credits are pivotal in developing necessary infrastructure. This presents homeowners with the opportunity to engage in major home improvement projects that focus on energy efficiency. Anticipating demands, home repair services will increasingly adapt to include energy-efficient designs that help homeowners manage costs.

Empowering Homeowners with Knowledge

The current legislation highlights the value of understanding energy trends and how they correlate with home remodeling. As families grow, ensuring homes are not just livable but energy-efficient is essential. Homeowners equipped with knowledge can make informed decisions about renovations, knowing how IRS credits can impact remodeling costs.

With the outlook promising a sustained boost in both the construction and renewal of energy sectors, now is the perfect time for homeowners to explore home renovation services. By tapping into local resources, families can enhance their living spaces while contributing to a more resilient energy landscape.

Add Row

Add Row  Add

Add

Write A Comment